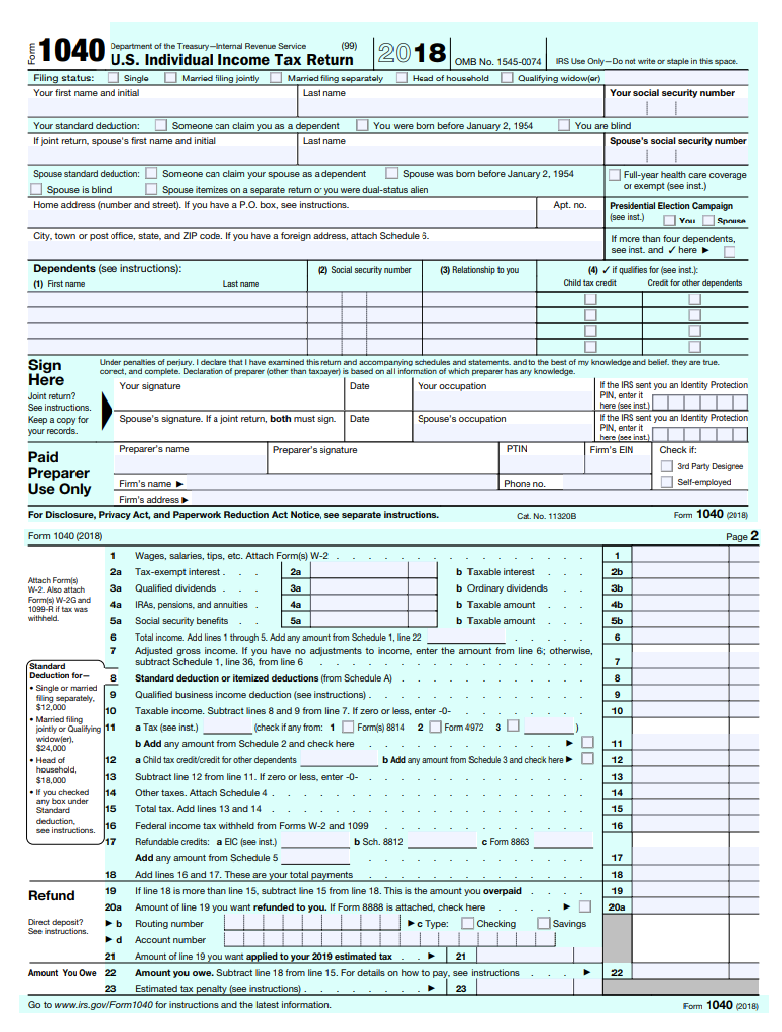

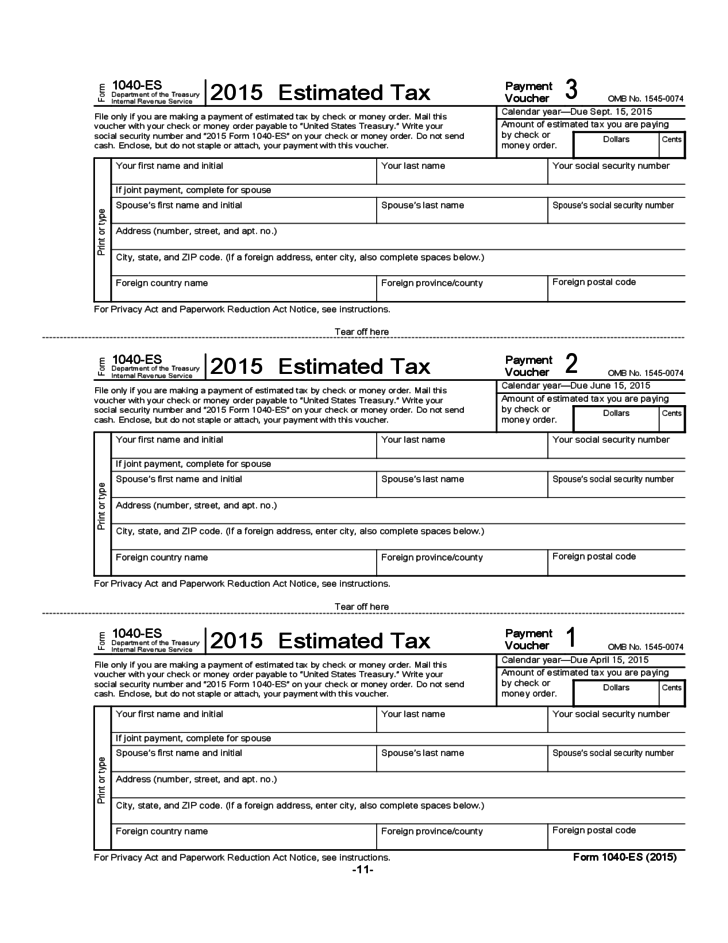

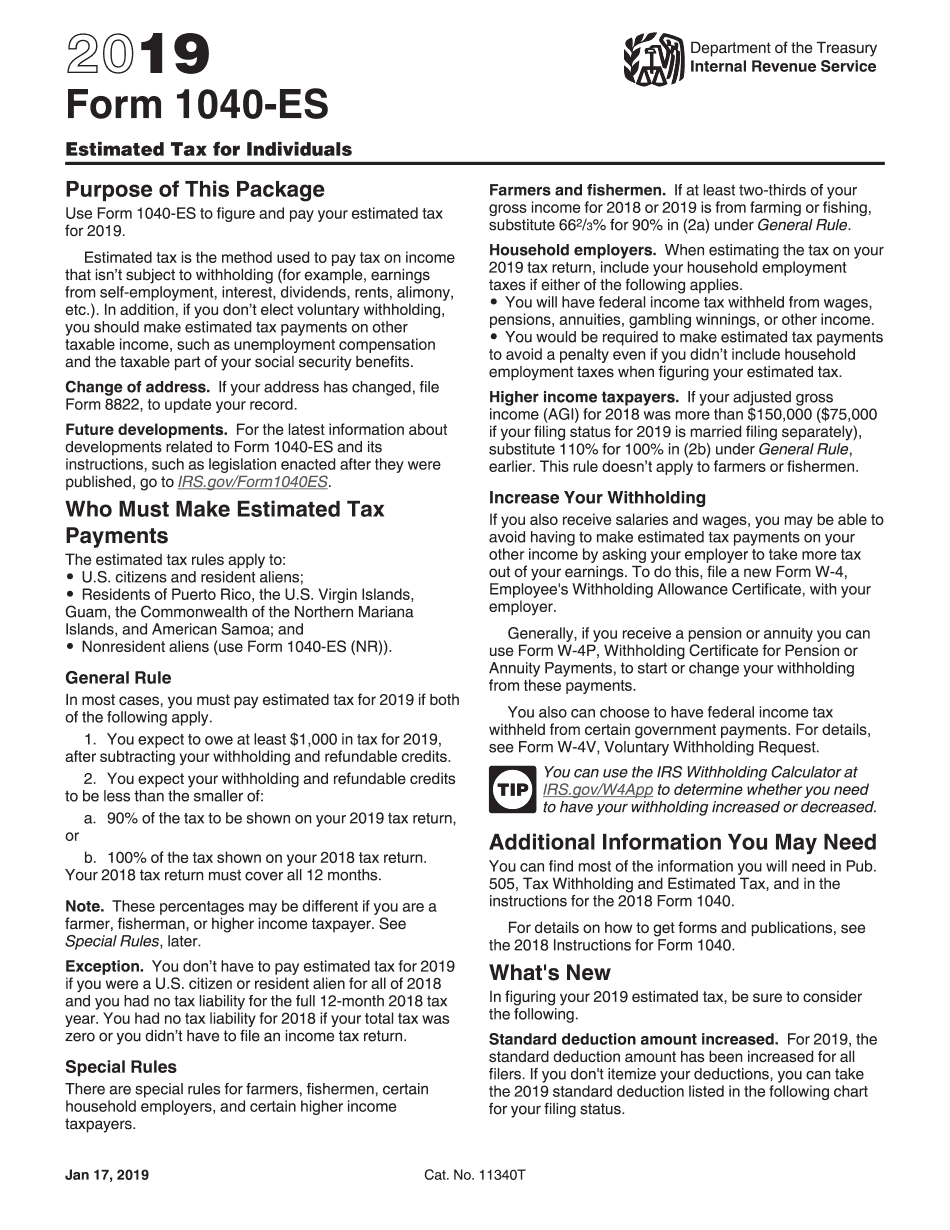

There are some instances that make it possible to avoid paying estimated taxes and filling out the IRS quarterly payment form.įor example, after applying your federal income tax withholding, you may expect to owe less than $1,000 in income this year. When sending a payment to the IRS, you must send one of the separate sections of the ES form. This is sent in addition to the IRS estimated tax payment form. Then you will send the payments based on your estimate to the IRS as a percentage of earnings that quarter. The form is organized into four separate sections, with one section per payment period, called the IRS quarterly payment form.Įvery quarter, you will make an estimate based on the previous year’s income. The ES form applies only to those who expect to pay more than $1,000 in income tax for the year. Since you are self-employed, it’s now your job to estimate how much you will owe in taxes and pay them yourself. Typically, if you receive a paycheck from your employer, your taxes are withheld from your paycheck. For example, people who own their own catering business, tutoring service, landscaping business or house cleaning service that is not incorporated as legal entity are all sole proprietors. Use our 2022 Tax Calculator to estimate your 2023 Tax Refund or Taxes Owed.Estimated taxes are paid each quarter to the IRS by any sole proprietor, LLC, or S corporation that is not subject to withholding taxes.Ī sole proprietor is someone who does not own a business that is incorporated, like an LLC or S-Corp.Need a Tax Amendment for a filed and accepted IRS and/or State Tax Return?.Find Tax Calculators, Tools, and Tax Forms for previous Tax Years or Back Taxes.

Access state income tax return forms and schedules plus state tax deadlines.

Otherwise late filing penalties might apply if you wait until the October deadline. You have until Octoto e-File 2022 Tax Returns, however if you owe taxes, you should at least e-File a Tax Extension by April 18, 2023. If you miss the e-file deadline, you will need to prepare and mail complicated IRS and state tax forms - prepare and file with each year so you do not have to worry about this!Ģ022 Tax Return Forms and Schedules - January 1 - Decemcan be e-Filed beginning January 2023. If you miss this deadline, you have until Octoto e-file 2022 Taxes.

Prepare and eFile your IRS and State 2022 Tax Return(s) by April 18, 2023. The 2022 eFile Tax Season starts in January 2023. Use the 2022 Tax Calculator to estimate 2022 Tax Returns - it's never too early to begin tax planning! The tax forms and schedules listed here are for the 2022 Tax Year tax returns and they can be e-filed via between early January 2023 and October 16, 2023. 2022 Tax Returns are due on April 18, 2023. IRS Income Tax Forms, Schedules and Publications for Tax Year 2022: January 1 - December 31, 2022.

0 kommentar(er)

0 kommentar(er)